NREL study examines impact of vehicle electrification on electricity demand

17 August 2018

The US DOE’s National Renewable Energy Laboratory (NREL) recently released another analysis from the Electrification Futures Study (EFS), a multi-year research collaboration to explore the impacts of widespread electrification in all US economic sectors—commercial and residential buildings, transportation, and industry. The report characterizes futures with widespread electrification—the shift from any non-electric source of energy to electricity at the point of final consumption—and quantifies the impacts of electrification on amount and shape of electricity demand.

When increased electrification rates are assumed, transportation becomes the major source of increased electricity demand, primarily due to the demand from light-duty plug-in electric vehicles (PEV)—a category that includes plug-in hybrid electric vehicles (PHEV) and battery electric vehicles (BEV).

The report makes it clear that the presented demand-side analysis is not predictive—rather, it is designed to enable a thorough assessment of the impacts of various levels of electrification. Technology adoption will ultimately depend on a set of considerations that were not assessed (but which are discussed) in the report. These factors include technology and fuel cost trade-offs, infrastructure needs, environmental policies, and consumer preference.

The report analyzed three electrification scenarios:

- Reference scenario: the least incremental change in electrification through 2050, which serves as a baseline of comparison to the other scenarios—essentially, a business-as-usual scenario. The assumptions for the transportation sector were: PEVs comprise 22% of 2050 light-duty car sales, 2.4% of light-duty trucks, and < 1% of medium- and heavy-duty trucks or buses.

- Medium scenario: a future with widespread electrification among the “low-hanging fruit” opportunities in electric vehicles, heat pumps and select industrial applications, but one that does not result in transformational change. In the transportation sector, PEVs comprise up to 69% of 2050 light car and truck sales, 29% of medium-duty vehicles (MDV), 10% of heavy-duty trucks, and 50% of all transit bus sales.

- High scenario: a combination of technology advancements, policy support and consumer enthusiasm that enables transformational change in electrification. The high scenario includes more-complete electrification across all end-uses considered such as LDVs, as well as significant adoption of electric HDVs—41% by 2050—even for long-haul applications. In the high scenario, electric vehicles would account for up to 76% of vehicle miles traveled in 2050.

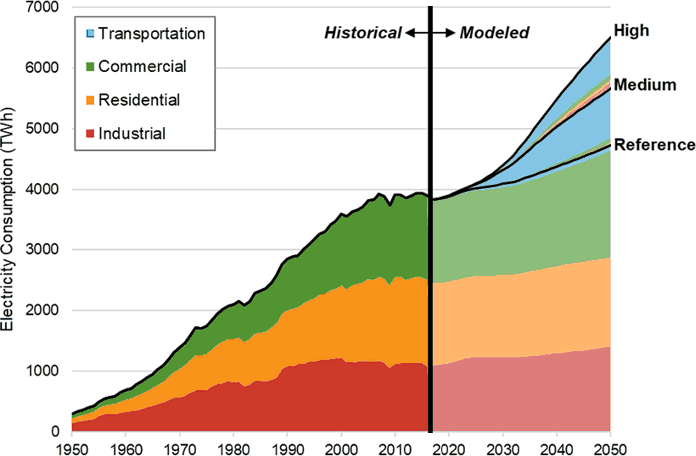

The modeled electricity consumption results, shown below, also assume that future electric technologies will be more energy efficient, resulting in 13% and 21% lower 2050 final energy consumption in the medium and high scenarios, respectively, relative to the reference. This higher overall efficiency of electric technologies is one reason that power demand does not grow even faster.

A key finding of the analysis is that electrification could significantly increase overall US demand for electricity. Widespread electrification increases 2050 US electricity consumption by 20% and 38% in the medium and high adoption scenarios, respectively, relative to the reference. These increases are even higher relative to 2016, as the reference scenario itself already includes an increase in electricity consumption.

The vast majority of this increase occurs in the transportation sector. Buildings electrification leads to more-limited incremental growth in annual electricity consumption in part because of the high efficiency of heat pumps and their partial displacement of inefficient electric resistance heaters.

Compound annual growth rates are found to be 1.2% and 1.6% in these scenarios, respectively. These growth rates are well below the historical rate from 1950 to 2016 (4%/yr) and fall below the 1.8%/yr growth rate observed over the same duration (34 years, 1982–2016) as the study future period.

However, comparing absolute year-to-year changes in consumption—rather than compound annual growth rates—shows how widespread electrification can lead to historically unprecedented growth. In the high scenario, the average increase (during 2016–2050) in annual electricity consumption is about 80 TWh/yr, compared with 50–55 TWh/year over the prior 34 years. The increasing demand is also in stark contrast to the flat or declining electricity consumption trend since the mid-2000s.

The share of electricity in total final energy consumption grows to 32% in the medium and 41% in the high scenario—significantly above 23% in the reference, and 19% in 2016. This growth in electricity share leads to reductions of on-site fossil fuel use; however, incremental fossil fuels could be used for power generation or exports.

Electrification would also lead to reduced use of gasoline, diesel, and natural gas fuel. Demand-side fuel use reductions of 74% gasoline, 35% diesel, and 37% natural gas in 2050 were found in the high scenario, relative to the reference. However, some of the reduced on-site natural gas use could be offset by greater gas-fired electricity generation.

The report does not include a supply-side analysis. Recent trends in the US electricity supply include the growth of solar and wind, stagnant quantities of nuclear and hydroelectric, growth of natural gas, and decrease of coal. Renewables—hydroelectric, wind, biomass, solar, and others—provide about 17% of electricity in the United States. Nuclear power produces some 20% of electricity, but—according to a recent study—the nuclear sector may be facing a steep decline.

Source: NREL: Electrification Futures Study (EFS)