Average CO2 emissions from EU cars increase to 120.5 g/km

4 March 2019

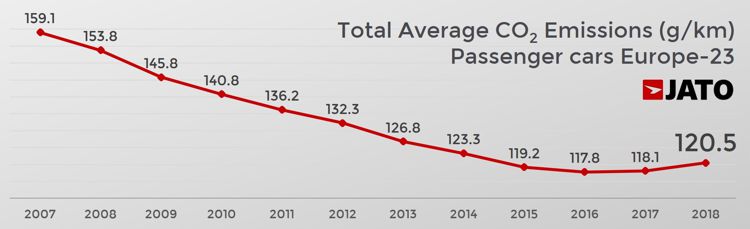

The total average of CO2 emissions from European cars increased by 2.4 g/km to 120.5 g/km in 2018—the highest average of the last four years. The analysis, carried out by Jato Dynamics, covered 23 markets in Europe and found a direct correlation between diesel car registrations and average CO2 emissions.

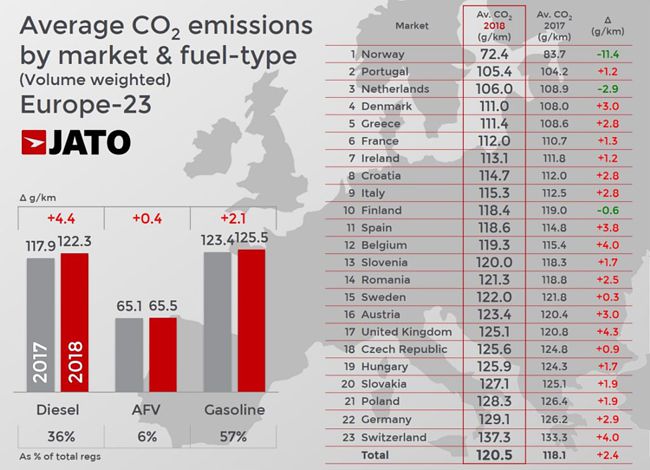

The diesel crisis, triggered by the Volkswagen emission scandal, resulted in a negative public perception about diesels and led to announcements of policy changes by governments that caused confusion and uncertainty among consumers. In 2018, EU diesel vehicles accounted for only 36% of all registrations, as their market share dropped 8 percentage points on 2017 and 19 points on 2011—the peak year, when EU diesel sales reached 55%. Most consumers who decide not to buy diesel, buy gasoline vehicles instead that have higher CO2 emissions.

The total value of CO2 emissions was on a steady decline from 2007, but in recent years the trend started to slowdown, as the fall reduced from -4.1 g/km in 2015 to -1.4 g/km in 2016. At the same time, the sales growth of diesel cars fell from +7% to +1%. This trend was confirmed in 2017 with the first average CO2 emission increase in years of 0.3 g/km, and an 8% drop in demand for diesel cars. Last year saw an even greater variation between demand for diesel (-18%) and an increase in CO2 emissions (+2.4 g/km).

However, the declining share of diesels is not the only reason for the CO2 increase. Other important factors include increased CO2 emissions from new diesels (+4.4 g/km from 2017), which appears to be driven by much better compliance with NOx emission limits in new diesel cars, as well as by larger vehicle sizes. The latter trend reflects the growing popularity of SUVs, many of them powered by diesel, among European consumers. Average CO2 emissions for SUVs increased by 1.4 g/km, and the SUV segment accounted for 35% of passenger car registrations last year—the only segment to post a positive change in 2018.

In addition, car makers have been accused of purposefully inflating CO2 ratings of new cars, in order to lower the effective stringency of the post-2021 emission targets, which are expressed as a percentage improvement over current actual emission levels.

The prospects for meeting the regulatory 2020 emission target of 95 g/km by the EU automotive industry are very slim, unless the market share of alternatively fueled vehicles (AFV), including plug-in hybrids and battery electric vehicles, increases rapidly. Manufacturers who fail to meet the target may be faced with substantial penalties.

A recent report by PA Consulting predicts that eight of the thirteen EU car makers are likely to miss their fleet average CO2 targets. Volkswagen faces a potential penalty of 1.4 billion euros (10% of its earnings 2017), reflecting the high number of cars it sells in Europe. Peugeot-Citroen (including Opel/Vauxhall) could see fines of 600 million euros, amounting to 20% of its earnings in 2017, and Ford and Fiat Chrysler could see penalties of 10% of their earnings in 2017.

Source: Jato Dynamics